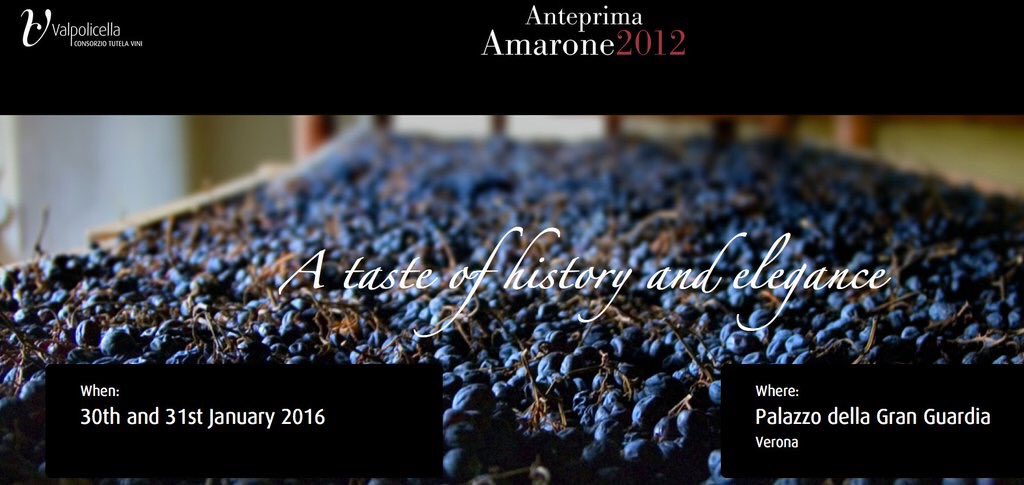

The preview of Amarone 2012 commences this Saturday January 30 through to Sunday January 31 2016 and is being in Verona, Italy at the historical Gran Guardia Palace in Piazza Brà. This two-day event is open to international press and winelovers.

.

For any further information visit: http://anteprimaamarone.it/

Here is the list of all the participating wineries:

Albino Armani 1607

Cantine Aldegheri

Blessed court ancient

Winery Bennati

Cantine Bertani

Boscaini Carlo Azienda Agricola

Cantine-Bolla

Cantina Buglioni

Ca’botta Vini

Ca’ dei Frati

Azienda Agricola Cà La Bionda

Ca’ Rugate

Cantina Di Soave

Cantina Valpantena

Cantina Valpolicella Negrar

Cesari Winery

Azienda Vitivinicola Corte Archi

Corte Figaretto

Court lonardi

Corte Rugolin

Corte San Benedetto

Corte Sant’alda

Dal Bosco Giulietta Azienda Agricola Le Guaite

Damoli Vini-Amarone Winery in Valpolicella

Degani

Amarone & Ripasso Falezze_DE

Azienda Vinicola Farina

Fasoli Gino

Fidora Wines

Vini Flatio di Flavio Fraccaroli

Vini Gamba

Clementi-Vini Della Valpolicella

Cantina Giovanni Ederle

Latium Morini

La Collina dei Ciliegi

La Dama Vini Valpolicella

La Giuva La Giuva Fanpage

Le Bignele-Soc. Agr. Aldrighetti Luigi, Angelo e Nicola

Le Marognole Vini

Azienda Agricola Marco Mosconi

Massimago

Monte Del Frà

Montecariano

Monte Zovo

Cantine Giacomo Montresor Spa

Novaia

Pasqua Vigneti e Cantine

Recchia Vini

Vigneti Di Ettore

Cantine Riondo

Roccolo Grassi

Azienda Agricola RUBINELLI VAJOL

San Cassiano Azienda Agricola

Santa Sofia.: I Classici Vini Veronesi dal 1811 :.

Casa Vinicola Sartori

Saints

Scriani Vinicola

According to Marco

Tenuta Chiccheri

Tenute Falezza

Tenute Salvaterra

Tenuta Santa Maria Valverde

Tezza Viticoltori in Valpantena

Casa Vitivinicola Tinazzi-Italians Inside

Valentina Cubi

Villa Crine

Villa Canestrari, Museo del Vino

Viviani

Vini Zanoni

Zonin 1821

Zýmē