In a recent study by Bordeaux Sciences Agro, Université de Bordeaux and Université de Bourgogne results were published in Nature Reviews Earth and Environment, showing 90% of coastal and low-altitude regions in southern Europe and California may no longer be able produce good wine in economically sustainable conditions by the end of the century if global warming exceeds +2°C. The study goes on to show that other regions could benefit: growing potential could increase in areas such as northern France and British Columbia (Canada), and rising temperatures could result in the development of new growing regions in countries as far as Denmark.

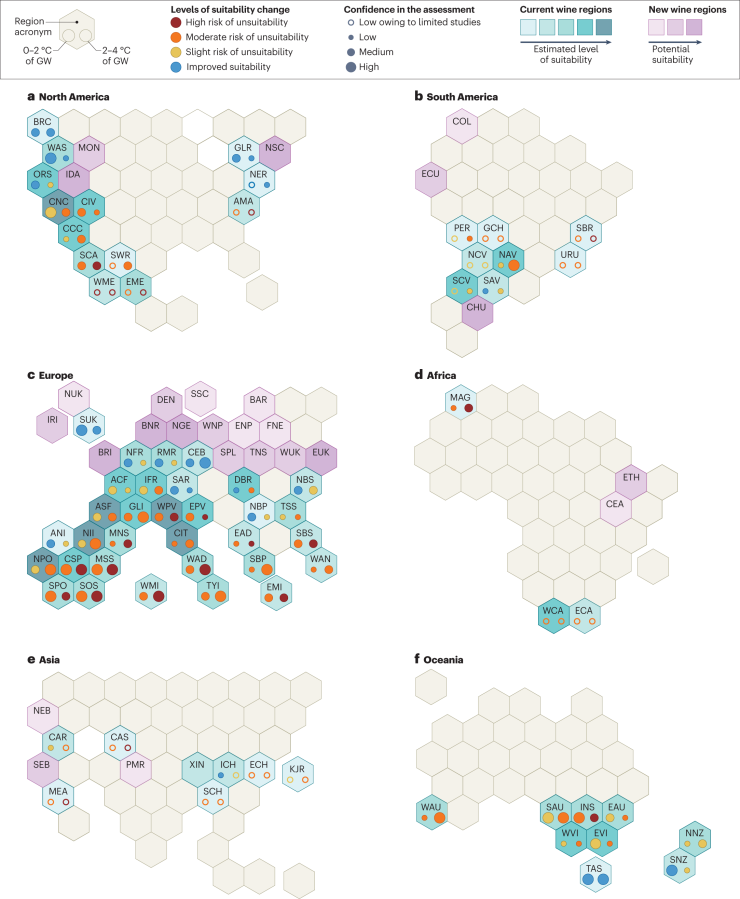

Grapes grown to make wine are sensitive to climate conditions such as temperature and extreme drought. These effects are already visible worldwide on yields, the composition of grapes and the quality of wines, with already and soon-to-be-observed consequences on the geography of wine production. Understanding shifts in wine production potential due to climate change is a major scientific concern. Based on their expertise and a thorough analysis of the scientific literature — over 250 publications in the last 20 years – a research team has established a global map of evolving trends in the threats and potential benefits that climate change brings to existing and new winegrowing regions. They did so by studying the effects of changes in temperature, rainfall, humidity, radiation and CO2 on wine production and exploring adaptation strategies.

Climate winners, climate losers

Winegrowing regions are primarily located at mid-latitudes where the climate is warm enough to allow grape ripening, but without excessive heat, and relatively dry to avoid strong fungal disease pressure. Rises in temperature – one of the most emblematic symptoms of climate change – accelerate vine development and the early ripening of grapes during the hottest periods in the summer. Harvesting in most vineyards now begins two to three weeks earlier than it did 40 years ago, with effects on grapes and the resulting styles of wines. Temperature increases, for example, can change how a wine tastes if grapes lose acidity, increase wine alcohol, and modify aromatic signatures. On a global scale, climate change could reduce growable surface area in current wine regions and increase it in others.

If global warming exceeds 2°C, some 90% of all traditional winegrowing areas in the coastal and plains regions of Spain, Italy, Greece and southern California may become unable to produce high-quality wine in economically sustainable conditions by the end of the century due to risks of excessive drought and more frequent heat waves. Conversely, higher temperatures could improve the suitability of other regions for the production of quality wines, including northern France, the states of Washington and Oregon in the United States, the province of British Columbia in Canada and Tasmania in Australia. They could even create new wine regions, in Belgium, Netherlands and Denmark.

Key Points:

• Climate change modifies wine production conditions and requires adaptation from growers.

• The suitability of current winegrowing areas is changing, and there will be winners and losers. New winegrowing regions will appear in previously unsuitable areas, including expanding into upslope regions and natural areas, raising issues for environmental preservation.

• Higher temperatures advance phenology (major stages in the growing cycle), shifting grape ripening to a warmer part of the summer. In most winegrowing regions around the globe, grape harvests have advanced by 2–3 weeks over the past 40 years. The resulting modifications in grape composition at harvest change wine quality and style.

• Changing plant material and cultivation techniques that retard maturity are effective adaptation strategies to higher temperatures until a certain level of warming.

• Increased drought reduces yield and can result in sustainability losses. The use of drought-resistant plant material and the adoption of different training systems are effective adaptation strategies to deal with declining water availability. Supplementary irrigation is also an option when sustainable freshwater resources are available.

• The emergence of new pests and diseases and the increasing occurrence of extreme weather events, such as heatwaves, heavy rainfall and possibly hail, also challenge wine production in some regions. In contrast, other areas might benefit from reduced pest and disease pressure.

Link to the full report:

https://www.nature.com/articles/s43017-024-00521-5