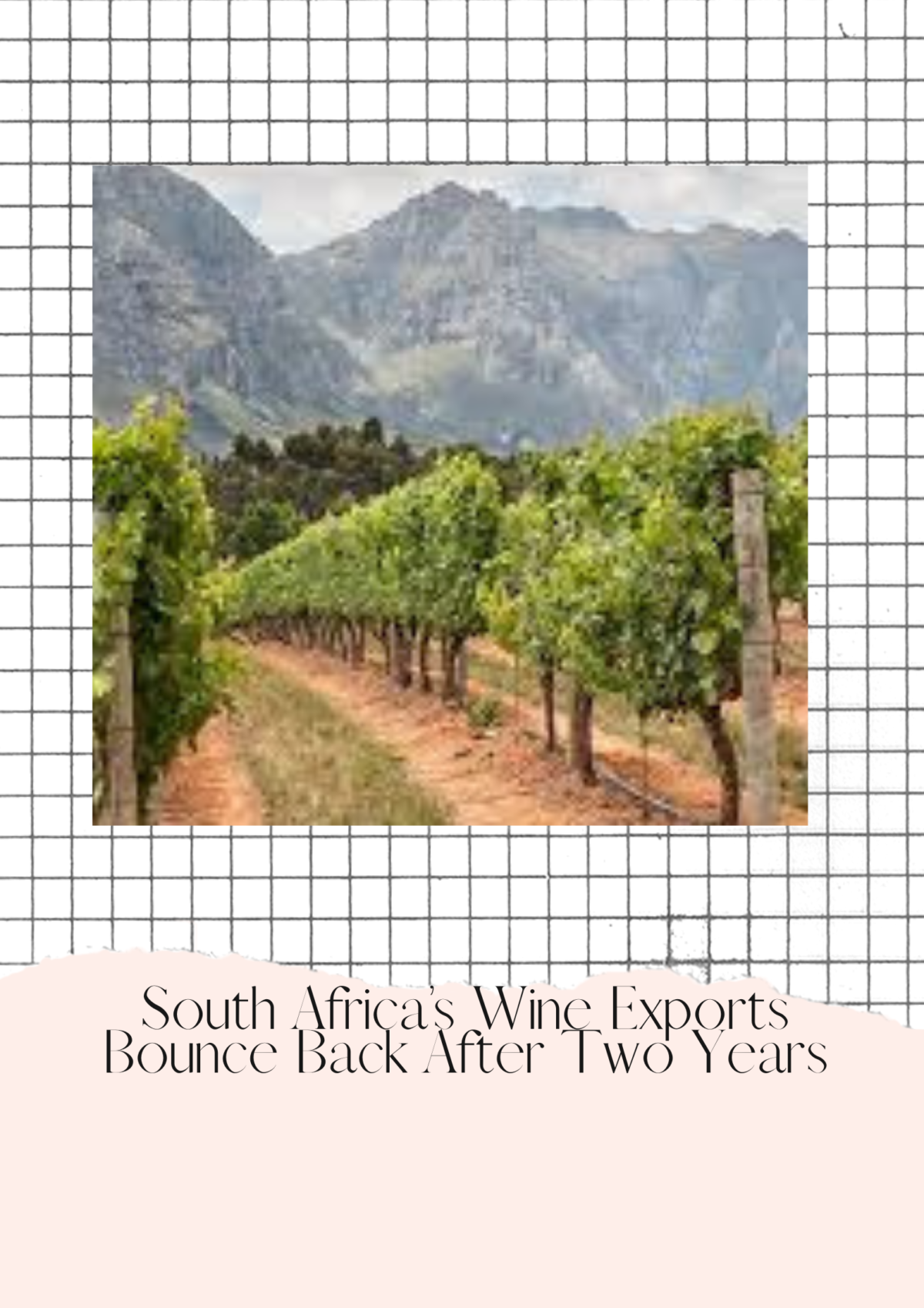

The SLO Coast Wine Collective announced this week that the San Luis Obispo Coast has been recognized as the newest American Viticultural Area (AVA) by the US Alcohol and Tobacco Tax and Trade Bureau.

Previously home to four AVAs: Paso Robles, Arroyo Grande, Edna Valley and York Mountain — SLO County has not had a new region approved for 30 years, since Arroyo Grande was last awarded the title in 1990.

The new AVA is a long, narrow strip of land that runs along California’s Central Coast, is 60 miles long and 15 miles wide. Currently, there are 32 wineries, that applied for the official status in 2017, making a case for the area’s unique and regional-specific characteristics including its proximity to the Pacific Ocean.

The SLO Coast AVA also includes 78 vineyards and around 4,000 acres under vine, with Chardonnay and Pinot Noir being the most dominant plantings, alongside Albariño, Grüner Veltliner, Riesling, Grenache, Syrah, Tempranillo and Zinfandel.

“We are one of the coldest spots to grow grapes because we are so close to the Pacific Ocean,” said SLO Coast Wine president Stephen Dooley. “What makes this area interesting is the low temperatures coupled with a lot of sunlight. Cool temperatures preserve acid, and in grapes like Pinot Noir, the sun helps with pigment, colour and tannin.”

#winenews #wine #redwine #whitewine #winelovers #vineyards #AVA #californiawines #cagrown #californiawinecountry #winecountry #californiawineries #winetravel #winetravels #winetraveler #viticulture #slocoastwine #slowine #coolclimatewine

![Cult Wines Americas – New “Innovative” Investment Platform [Part 2]](https://www.liz-palmer.com/wp-content/uploads/2022/03/Cult-Wine-Investment-Article-2.png)