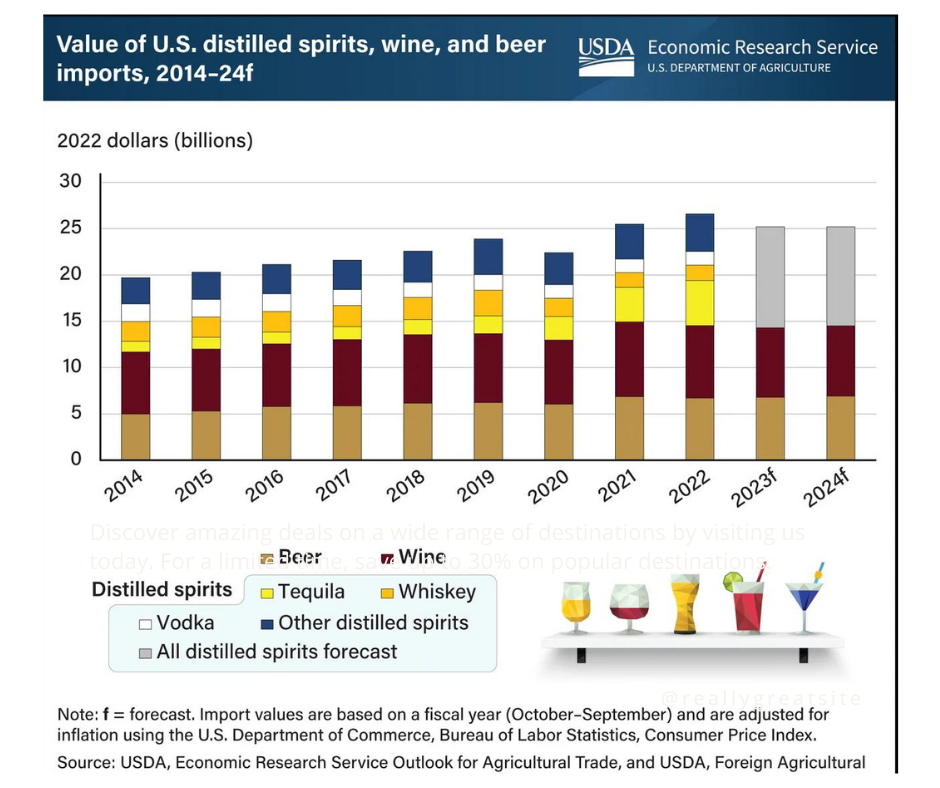

The United States imported $26.6 billion in alcoholic beverages in 2022.

Total U.S. imports of distilled spirits, beer, and wine accounted for 14 % of all U.S. agricultural imports.

Distilled spirits were the largest and fastest-growing segment of these products, accounting for almost half or $12 billion of U.S. alcohol imports.

Source: USDA Economic Research Service