Vinexposium announced that two co-located events—Vinexpo America and Drinks America—that will reunite the beverage alcohol industry (in person) under one roof, in 2022. The trade-only expos will be held March 9-10, 2022, in the new Hall 3 at New York City’s Jacob K. Javits Convention Center. Together, they promise to attract top buyers and decision-makers from across North America, the largest and fast-growing beverage-alcohol-consuming market in the world.

Vinexpo America is a repositioning of the former Vinexpo New York, which for three years served as the premier international exhibition for wine and spirits professionals in North America before a 2021 pause due to the COVID-19 pandemic. In its new form, Vinexpo America will focus exclusively on wines, with representation from all of the world’s top-producing regions.

Drinks America is a brand-new expo created in response to a forecasted continuing rise in consumption of spirits and ready-to-drink beverages. It will feature a wide array of spirits, beer and sake from producers across the globe as well as beverage alcohol accessories and services.

Both events will provide U.S. and Canadian buyers access to new and established brands that are looking to expand distribution, network and meet with existing customers in North America. From conferences to master classes, two full days of educational programming will address issues relevant to both the wine and spirits worlds.

For attendees, Vinexpo America | Drinks America offers the advantage of one registration for full access to both shows’ exhibits, programming and events—a great value that also optimizes efficiency as they can meet with producers from around the world in one location over two days.

Exhibitors will benefit from visibility to all buyers, decision-makers and influencers from both events, plus unlimited free guest invitations. A new business matchmaking service will facilitate one-to-one meetings during the two-day exhibition.

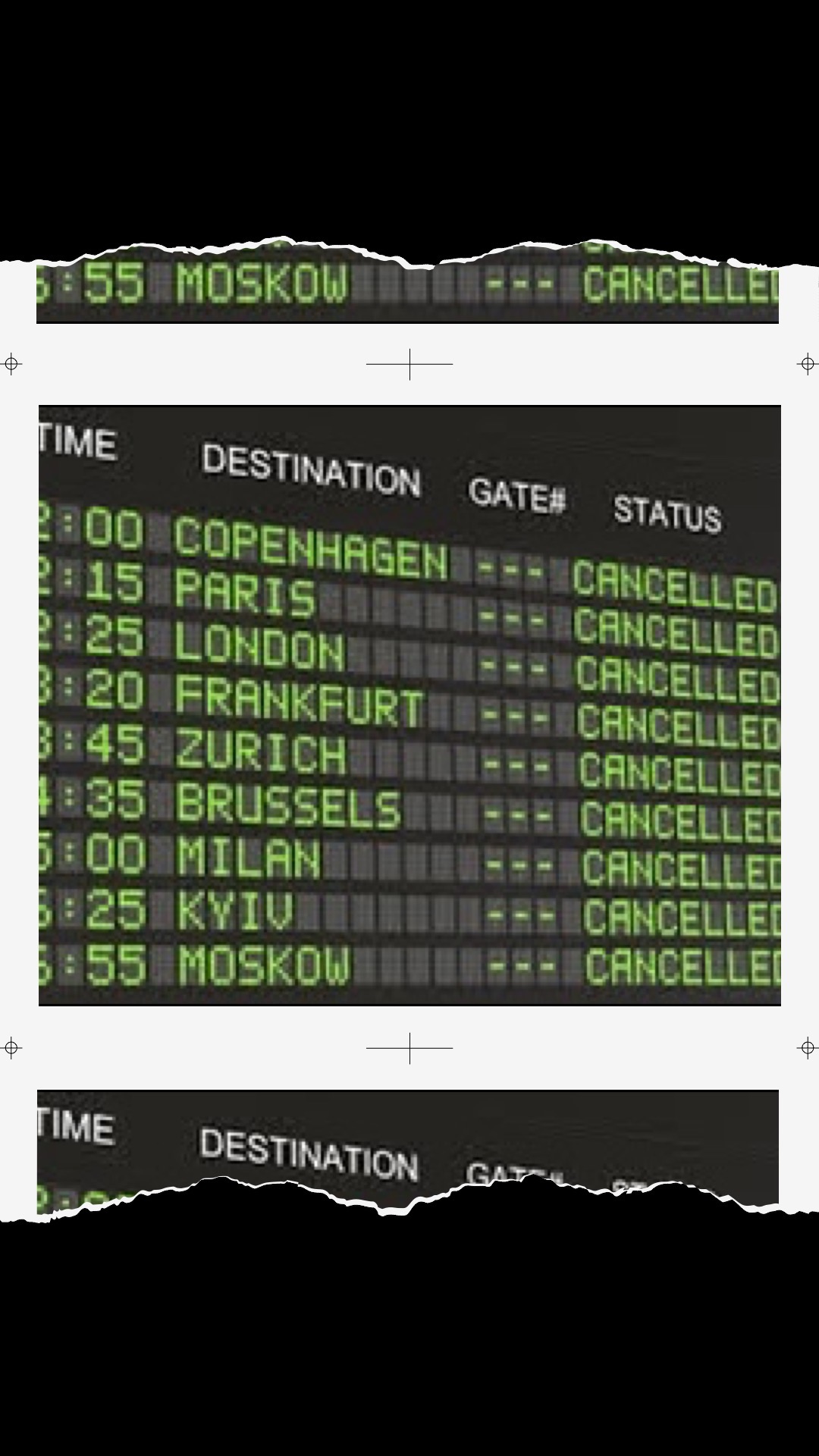

“We’re excited to renew our partnership with Vinexposium and come back to New York in 2022 with a brand-new, greatly enhanced offering,” said Mary Larkin, president of Diversified Communications USA. “Bringing together Vinexpo America and Drinks America in a single meeting place will enable us to serve the entire U.S. wine and spirits communities—an especially welcome opportunity after the COVID-19 pandemic forced the cancellation of the industry’s major exhibitions in 2021.”

“The launch of our events in the United States in 2022 is designed to coincide with the resumption of trade between Europe and the USA. Under a new name, Vinexpo America aims to embrace the entire North American market, alongside Drinks America. It has become crucial to offer our customers a comprehensive business platform that matches the scale of the American continent and includes spirits, craft drinks and beers alongside wine,” stresses Rodolphe Lameyse, CEO of Vinexposium.

More information regarding the 2022 event will be announced in the coming months.

#GlobalWineevent #inperson #VinexpoAmerica #DrinksAmerica #vinexpo #winenews #tradeevent #wine #winelovers #Vinexposium #wineevent #instawine #wineevent2022