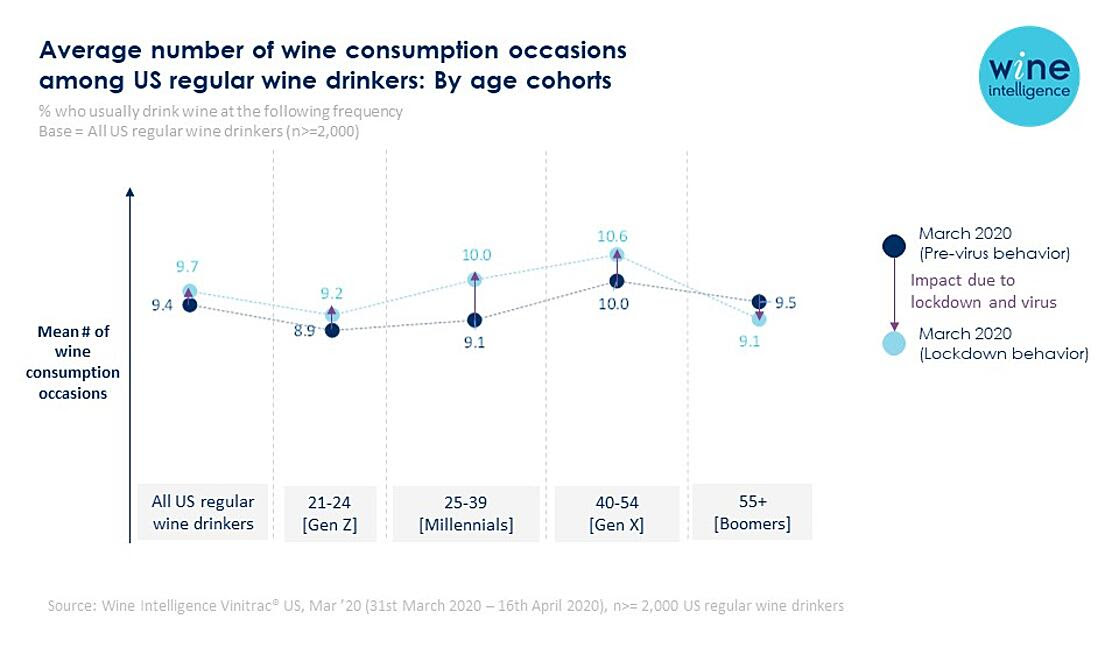

America’s 77 million regular wine drinkers upped their frequency of wine consumption during the pandemic lockdown, despite the closure of many on-premise establishments, according to new consumer research out this week.

The new Wine Intelligence US COVID-19 Impact Report polled a nationally representative sample of 2,000 monthly US wine drinkers during March and April 2020 to understand how their wine drinking behavior was changing as a result of the restrictions due to the coronavirus. The findings paint a picture of a nation finding new occasions for wine drinking – at lunchtime, or catching up with friends online, or replacing the trip to the restaurant with a more indulgent evening meal.

The growing volume of wine purchased was tempered by a small decline in the average price per bottle paid overall, according to the research. However, within this average were significant variations by consumer type. More involved and committed wine drinkers, who mainly spend between $15 and $20 per bottle normally, tended to spend a bit more than usual, while less frequent wine drinkers tended to spend a bit less.

There was significant growth in online shopping across all age groups, with the most likely users of online channels being younger, urban, affluent consumers. This same demographic, who in normal times are more likely to drink wine in social settings such as bars and restaurants, also tended to spend more on take-home purchases.

While the majority of respondents said the origin of wine they bought during this period stayed the same, there was a notable shift in purchase preferences towards domestic wines and away from imports. Some 18% of respondents reported buying more wine from California and other US regions during this time, while 20% said they were buying less wine from France, Italy and Spain. Additionally, US wine drinkers increased their trust in California wines and conversely, lost trust most among old world wines, particularly those from Italy.

Looking to the future, US wine drinkers, on the whole, expressed caution about going out to bars and restaurants immediately after lockdown restrictions were ended – around 40% said they would be less likely to visit a restaurant, while 27% said they would be more likely.

Analysis of this data suggests there is a distinct attitudinal contrast at work among consumers. At one extreme is an optimistic and active group who have made minimal changes to their lifestyle and are less nervous about returning to the on-premise – they tend to be younger, more affluent and city-based, and comprise about 17% of monthly wine drinkers. At the other extreme, 20% of monthly wine drinkers have reacted strongly to the lockdown, and have significantly cut down on spending and wine consumption, and are very reluctant to return to an active social life.

The Wine Intelligence US COVID-19 Impact Report will be published on the 6th of May 2020. It includes latest insights pre, during and predicted post-COVID-19 restrictions, including beverage repertoire, wine buying and consumption behaviors, brand health and lifestyle behavior changes.

Commenting on the report, Wine Intelligence CEO Lulie Halstead said: “Our data supports other evidence that shows that US wine drinking is holding up and that sales will continue to be solid once lockdown ends. In fact, there are clear opportunities with certain consumer segments right now and also in the medium term as we move to post-lockdown behavior. Looking ahead, the US wine drinker is understandably quite cautious about their household finances and the idea of getting on a plane. Thankfully for the wine category, their intention seems to be replacing big treats like vacations and big events with small treats like a nicer bottle of wine.”

Source: Wine Intelligence