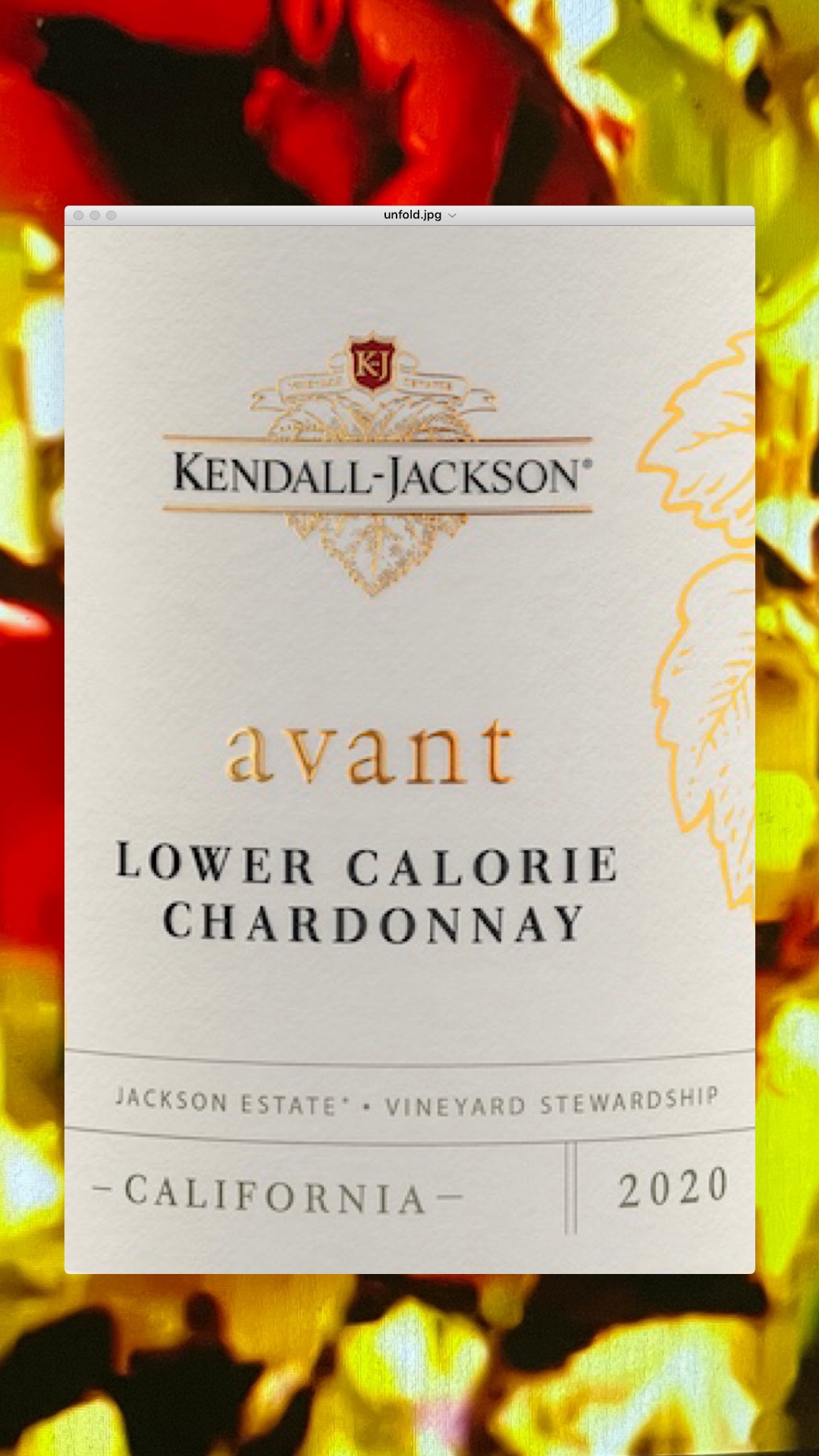

Kendall-Jackson is launching a lower calorie variant to tap into the ‘lighter wines’ category in the US.

Starting in May this new offer will be under the Kendall-Jackson brand. Did you know that Kendall-Jackson Vintner’s Reserve Chardonnay has been the most popular Chardonnay in the US for over 26 years?

This low-calorie chardonnay will be called “Avant” is only 85 calories, has no sugar, and has 3 grams of carbs per serving” according to the producer.

This new low-cal wine contains 23% fewer calories than the standard Kendall-Jackson Chardonnay, based on a 150ml serving of wine at 14% abv, which contains 111 calories.

Kendall-Jackson winemaker Randy Ullom explains, “An initial harvest of grapes picked on the earlier side ensures lower sugar. A secondary harvest later in the season offers more complexity and concentration, which complements the wine, producing a full-bodied blend that’s structurally balanced and delicious, yet lower in alcohol and calories.”

Like the Vintner’s Reserve, the Avant Chardonnay is aged in oak barrels to bring a touch of vanilla to the wine, which is described as tasting of “grapefruit, pineapple, creamy lemon meringue and delicate white flowers”.

The 9% Chardonnay is also vegan-friendly and comes with an RRP in the US of $17.

Jackson Family Wines highlighted the commercial potential for this new wine by noting that the ‘lighter wines’ category had grown by 90% in the US in 2020.