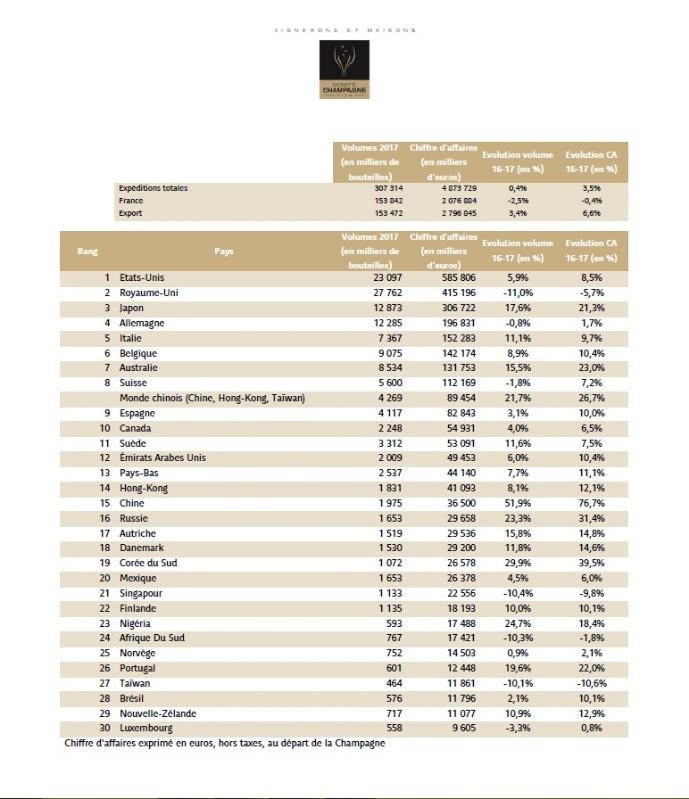

Japan has overtaken Germany in export volumes of champagne for the first time in history, according to recent data provided by Comité Champagne.

Japan imported 12.8m bottles between 2016-17, which is a 21.3% increase on the previous year, leapfrogging them above Germany into third place.

“Over the past 20 years, Japan has produced 3,000 sommeliers and the country has a real passion for champagne,” said Vincent Perrin, deputy direct general, Comité Champagne.

“Japan has a strong distribution network and benefited from the free trade agreement announced with the EU.”

The US remains the number one for exports in terms of value, with more than half a billion Euros recorded in 2017, however the UK imported almost 28m bottles over the same period, a global high despite recording an 11% decrease in volumes.

Perrin adds: “There is an uncertainty with the UK due to the effects of Brexit, however the French economy is in a good place so we’re expecting big things for 2018, specifically in the on-trade.”

China grew 76.7% in terms of volume in 2017, the largest increase globally and the country is now ranked 15th in the world.

“These are promising signs from China, but I think they need educating on wines that aren’t Bordeaux reds before they become truly influential,” said Perrin.