- The Liv-ex 1000 continued its bull run into the new year, rising 3.5%.

- The Burgundy 150 was its best-performing sub-index, up 6.4%.

- Champagne 50 and Rest of the World 60 followed, both rising 5.6%.

The broadest measure of the market, the Liv-ex Fine Wine 1000 index, rose 3.5% in January to close the month at 439.3.

The index is up 22.3% over one year versus 25.2% for the industry benchmark, the Liv-ex 100. All of the Liv-ex 1000 sub-indices increased last month.

Burgundy outperforms the broader market

The Burgundy 150 index was the best performer, up 6.4%. Prices for the region’s wines continue to soar, driven by looming shortages. Meanwhile, the 2020 En Primeur campaign stimulated demand for back vintages and the region took 24.6% of the market by value last month.

Both the Champagne 50 and the Rest of the World 60 sub-indices rose 5.6%.

Louis Roederer Cristal 2008 – the most traded wine by value in January – was also the top price performer in the Champagne 50, up 19.2%.

The biggest mover within the Rest of the World 60 was Dominus 2015, up 17.7%.

The Bordeaux 500 index has continued to lag behind the other sub-indices, rising just 1.0% in January. The performance of its sub-regions has been mixed, with some of the best-performers coming from Pomerol and rising between 14% to 18%.

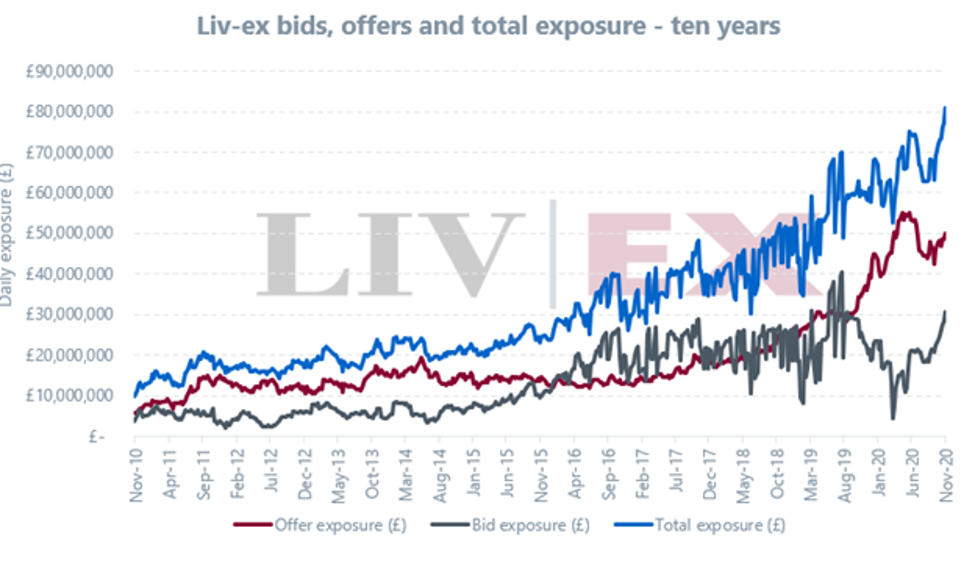

Source Liv-Ex

#finewine #wineinvestment #wineinvestors #champagne #winenews #bordeaux #burgundy #frenchwine #livex #alternativeinvestment #investment #alternativeinvestments

@livexwine

![The 2021 Fine Wine Market Report [Liv-ex]](https://www.liz-palmer.com/wp-content/uploads/2021/12/Image-1.jpg)