Moët & Chandon, Veuve Clicquot, Taittinger and other champagne houses could spearhead a move into China, in an indication of changing tastes.

Moët & Chandon, Veuve Clicquot, Taittinger and other champagne houses could spearhead a move into China, in an indication of changing tastes.

Robert Beynat, chief executive of Vinexpo, was speaking to the Wall Street Journal following the publication of a new study.

99.5% of wine currently consumed in still wine. “The Chinese ignore the sparkling wines right now,” Beynat said.

He attributed this to a shortage of marketing by the champagne industry, and said leading brands would play an important future role in educating Chinese consumers about sparkling wines.

The overall growth in wine consumption in China is expected to slow to 39.6% over the next four years, compared with the 142% increase seen between 2007 and 2011.

Vinexpo expects 252m cases of wine to be consumed annually in China by 2016, up from 159m in 2011.

Beynat said the slowdown was a natural correction after the explosion in demand witnessed in China in recent years.

Nonetheless, he anticipated that the country would remain a growth story, as he pointed out China is expected to become the world’s sixth largest wine producer in 2016, ahead of Chile and Australia. “The more you produce, the more you drink,” he noted.

French wines still rule the Chinese market, accounting for around 48% of imports in terms of volume.

China’s per capita consumption is predicted to increase from 1.4 litres of wine per person to 2.1 litres over the next three years. This remains far behind France, the top nation on this metric, at 53.2 litres per person.

Source: AFP/Wall Street Journal

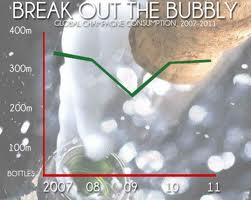

Champagne exports 2011 reached their second highest volume in five years – with sales close to the peak of 2007. Exports in 2011 were up by 5.1%, rising to a total of 141.2m bottles, the second largest volume ever achieved behind 2007 and only 9.5m bottles less than this peak, according to the latest statistics just released by Champagne’s governing body CIVC.

Champagne exports 2011 reached their second highest volume in five years – with sales close to the peak of 2007. Exports in 2011 were up by 5.1%, rising to a total of 141.2m bottles, the second largest volume ever achieved behind 2007 and only 9.5m bottles less than this peak, according to the latest statistics just released by Champagne’s governing body CIVC.