The opening dates of the 2019 harvest in Champagne have been announced, for all the villages and departments of the appellation.

The CIVC states: “The 2019 campaign has been marked by climatic shocks, with cool and humid periods alternating with hot and sometimes hot periods. Since the buds hatched, nature and some of the vine’s enemies have drained some of the initial harvest potential. Compared to other vintages, this year the grapes have more acidity and less color to the same degree (sugar richness). Aromatic maturity will therefore probably only be reached with high potential degrees, in the order of 10.5% flight. for Chardonnays and Black Pinots and 10% vol. for Meuniers”

The harvest, which began in Champagne this week, looks to be lower than in previous years. The vines of Champagne saw everything this year, from cold and rain to drought and heat, with the previous record for sunshine hours broken in February.

Spring frosts between early April and early May destroyed the vine buds across around 1,000 ha of vineyards, equivalent to three percent of the vineyard area. The heat and drought periods that began in June did not affect the vines.

The yield available for vinification this year was limited to 10,200 kg per hectare, which is slightly lower than in 2018 (10,800 kg per hectare).

The grapes from vintage 2019 show high acidity, but balanced color and sugar. In order to achieve the aromatic ripeness desired in Champagne, the grapes require a minimum alcohol content of 10.5% by volume for Chardonnay and Pinot Noir and 10.0% by volume for Meunier.

Champagne harvesting is done exclusively by hand to guarantee the integrity of the fruit for whole cluster pressing. The harvest is supported by 120,000 workers.

Source CIVC

https://www.champagne.fr/en/

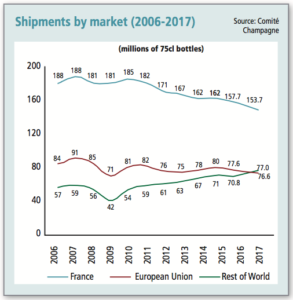

Estimated figures for total shipments during 2018 show that more Champagne was consumed in foreign markets than France for the first time in over 50 years.

Estimated figures for total shipments during 2018 show that more Champagne was consumed in foreign markets than France for the first time in over 50 years.