This week at a press conference held at Wine Paris & Vinexpo Paris, David Chatillon and Maxime Toubart, co-Presidents of the Comité Champagne, expressed their optimism for the future. Collectively, Champagne winegrowers and houses have taken strategic decisions and have launched numerous projects to ensure balance within an appellation that continues to sparkle across the globe. Initiatives include the commitment to regulation and social responsibility, the introduction of a new framework for contractual relations between winegrowers and houses, an increase in the reserve level, as well as the construction of Qanopée and a new research and development centre in Epernay; all of which bear witness to the industry’s ongoing commitment in ensuring Champagne remains desirable, available and exemplary.

1) A committed and responsible industry

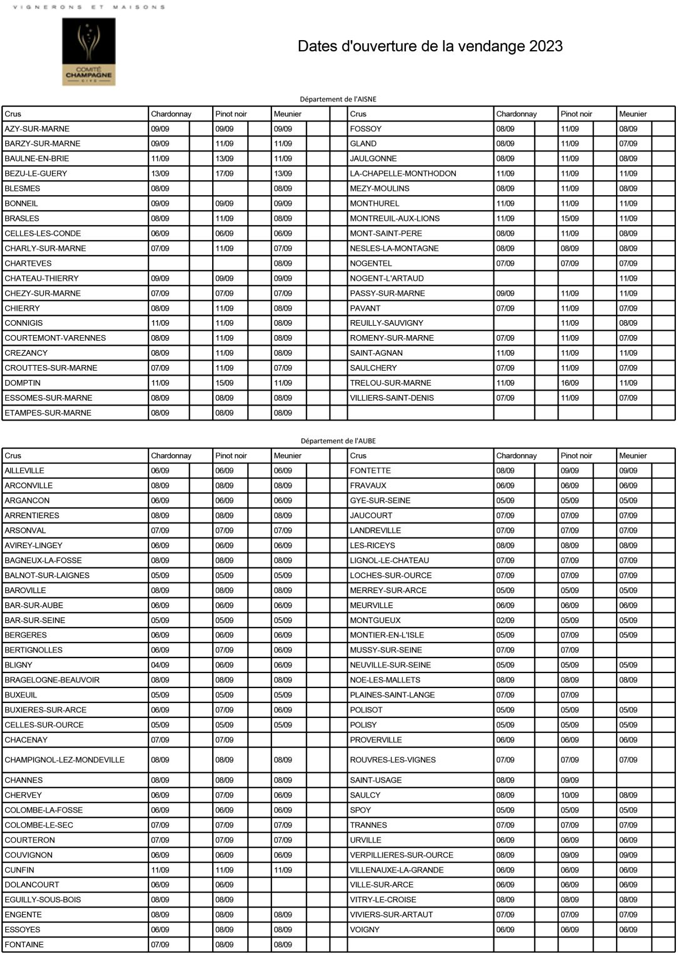

To address the challenges linked to the employment of grape-pickers, Comité Champagne has asked public authorities to severely condemn the unacceptable behaviors that occurred during last year’s harvest.

It has also launched a strategic plan for the following four pillars:

Accommodation;

Working conditions, health and safety of harvesters;

Securing the supply of service providers; and

Facilitating recruitment.

Initial progress will be shared before the 2024 harvest.

“We are committed to providing a better framework during this crucial period, and to dealing with the fundamental issues. The aim is to ensure the smooth running of the harvest, which mobilizes 100,000 grape-pickers every year,” says Maxime Toubart, President of the Syndicat Général des Vignerons and co-President of the Comité Champagne.

In addition, the contractualization agreement governing the Champagne grape market has been renewed for a 5-year period. It secures market supply and consolidates the sharing of value.

2) An innovative industry

Champagne has a long-standing tradition of innovation, adapting to new challenges and evolving climates.

As part of the national plan to combat vine decline, the Comité Champagne is continuously involved in fighting against new diseases, including the flavescence dorée, and has equipped itself with tools to ensure the long-term survival of the vineyard, and preserve the distinctiveness and excellence of Champagne wine:

Construction of an “insect-proof” greenhouse: This new-generation greenhouse, built as part of the QANOPÉE project including Champagne, Beaujolais, and Burgundy wine-growing regions, is designed to secure the production of vine plants in north-eastern France. Inauguration is scheduled for summer 2024.

An expanded research, development and innovation centre at the future Maison de la Champagne in Epernay. Announced last year, construction is just about to begin. This centre will reinforce the industry’s initiatives for quality and sustainable development, with state-of-the-art equipment.

Raising the reserve level: a crucial tool for regulating Champagne production, the reserve enables a portion of the wines produced during good harvests, to be kept for future use in any deficit years. To guarantee a stable marketable yield each year and further improve the resilience of the

sector, the reserve level has been raised from 8,000 kg/ha to 10,000 kg/ha.

3) A strong appellation

For over 120 years, winegrowers and Champagne houses have been working together to protect the appellation and ensure its worldwide influence.

In line with ambitions to expand its network of embassies around the world, a new Champagne Office will open in Stockholm next April, representing the industry in the Nordic countries (Sweden, Norway, Finland, Denmark). It will be the local point of contact for media, wine professionals, importers and government authorities in Scandinavia. This expansion is justified by the growing importance of these markets, with demand steadily rising over the last ten years (+67%).

Wine professionals around the world express a strong enthusiasm for Champagne. A recent qualitative study revealed their deep emotional connection with the product, highlighting its unique character. To further cement their connection to the appellation, training is crucial. That’s why the Comité Champagne is launching “Champagne Education”, a comprehensive, certified programme designed to train wine professionals and reinforce their role as ambassadors. This programme is already being rolled out, in partnership with renowned schools around the world (including the Ecole du Vin in Paris, the Napa Valley Wine Academy in the USA, the Cordon Bleu in UK and the Deutsche Wein und Sommelierschule in Germany).

Finally, the battle for recognition and protection of the Champagne appellation continues. In 2023, after several significant wins against misuses of its name – notably in Canada and Italy – Champagne was granted “notorious name” status in China, a first for a foreign appellation in China. This proves to be a huge step forward, providing further protection against any fraudulent use of the name Champagne, for any product, including any writing in Chinese characters.

“The continued investments and commitments we are making for the industry’s resilience are an absolute priority to give us the means to ensure long-term market balance, as well as ensure that Champagne remains an exceptional wine,” comments David Chatillon, President of the Union des Maisons de Champagne and co-President of the Comité Champagne.

4) Champagne remains THE benchmark

Champagne remains an undisputed benchmark for consumers. According to an IPSOS study in 2023, Champagne still embodies luxury, prestige and elegance. Consumers associate this wine with unique memories and emotional connections, making it the ideal choice to mark important moments and special occasions.

5) Renewed consumption and markets

The final reason for Champagne’s optimism lies in the renewal of consumption and markets.

Confined to “non vintage brut” for a long time, consumers are now looking for greater diversity in blends and dosage.

Demand for rosé Champagne abroad has increased 5-fold in 20 years. By the end of 2022, it represented over 10% of export sales, with 20 million bottles.

Low dosage wines (extra brut and zero dosage) are also on the rise, with volumes increasing almost 70-fold in the space of 20 years (6.4 million bottles exported in 2022).

Exports now account for almost 60% of total sales (171.7 million bottles), compared to 45% ten years ago, but many markets remain to be conquered. While 80% of Champagne is still sold in 8 countries, new markets such as Canada, South Africa and South Korea are showing growing interest in Champagne and have recorded remarkable growth in recent years.

Sustainability Update

With the Champagne region located at the northernmost portion of prime grape-growing latitudes, growers have spent more than a century thinking about climate and its impact on weather. As the world grapples with climate change, it’s no surprise Champagne is at the leading edge of sustainability practices.

Champagne in 2003 became the first wine-growing region in the world to conduct a carbon footprint assessment, identify the main sources of emissions, and enact a plan to curb those emissions. Since then, Champagne producers have cut CO2 emissions generated by each bottle of Champagne by 20 percent. The region aims to achieve Net Zero Carbon by 2050.

While honoring our traditions, Champagne also embraces the science of viticulture. Over the years, that has meant adopting new techniques to protect our vines from disease, create optimal yields, and husband our resources. The region is experimenting with soil management, growing practices, vine spacing, grape ripening, harvesting techniques and fermenting practices to prepare for the effects of climate change.

In 2014, the Champagne region planted new varietals to determine how they would fare in an era of extreme weather. Comité Champagne is continuing to evaluate these varietals to ensure the quality and yield meets the high standards for which Champagne is known, a process that takes at least 15 years. If new varietals are chosen, they will need to be registered in the French catalogue of vine varietals and added to the Champagne protection denomination of origin specifications.