Despite the headwinds of 2020 – tariffs, Brexit uncertainty and the global pandemic – the wine market has remained robust. Today’s post examines what has changed and offers an explanation as to why we are seeing greater confidence in the market during these exceptional times.

Increased liquidity

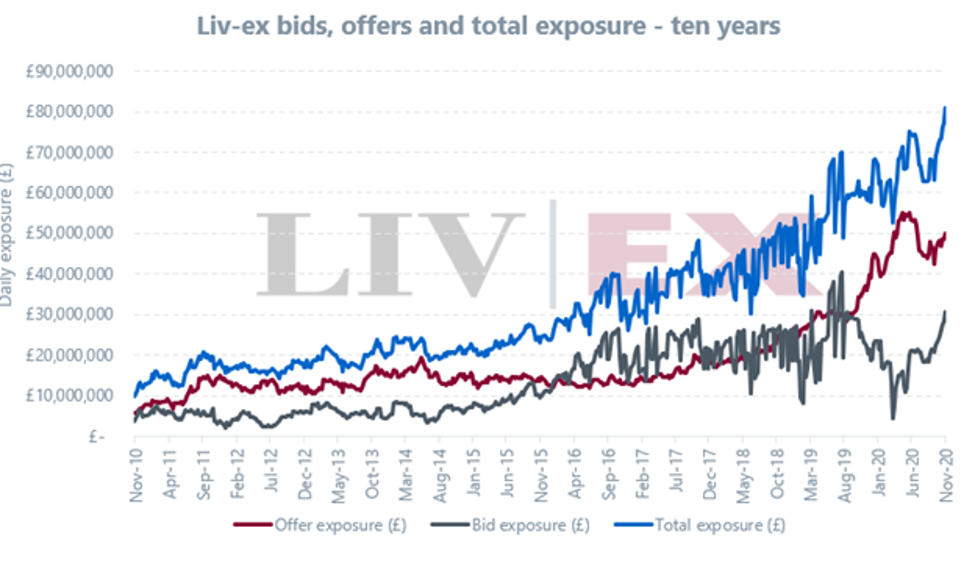

One of the key changes this year is an increase in market liquidity, which is reflected in the rising value of bids and offers on the Liv-ex marketplace. The total exposure (total value of bids and offers) reached a new record high of £81 million last week – a £30 million increase this time last year.

In recent months, both bids and offers have been on the rise. The bid to offer ratio (i.e. the total value of bids divided by the total value of offers) currently stands at 0.6. Traditionally, a bid-offer ratio of 0.5 or higher suggests positive sentiment.

A broadening market

Another noticeable difference is that more wines than ever are attracting buying interest, taking market share from the traditional strongholds of Bordeaux and Burgundy. As the chart below shows, the wine market has undergone considerable broadening in the past decade. Bordeaux’s share has halved from its peak in 2010 when it accounted for 95.7% of secondary market trade by value. As its share declined, others shined. Burgundy was the first and main benefactor; its trade share rising from 0.6% in 2010, to a record high of 19.7% in 2019. It has dipped slightly this year to 17.4%.

This year, Italy has been the big winner. Having reached an annual average of 8.8% in 2019, Italy now accounts for 15.3% of fine wine trade. As recently highlighted, the US wine market is also developing at unprecedented rate. USA accounted for just 0.1% of trade in 2010. Year-to-date, it stands at 7%.

And then, there is the Rest of the World – an increasingly diverse category. Up from 0.8% in 2010 to 5.9% in 2020, RoW trade so far in 2020 has been led by trade for Australia (1.8%), Spain (1.4%) and Germany (1%), though wines from Argentina, Austria, Chile, and Portugal to name but a few are seeing more and more activity.

What has changed?

So, why are we seeing such increased confidence in the wine market? One well-documented explanation is that investors are seeking to put their money into safer assets in these uncertain times. Historically, fine wine has offered steady returns and low volatility. Another explanation is that there are simply more market participants than ever before. The number of wine businesses trading on Liv-ex has increased 15% in 2020 alone. This increase in members reflects a growing trend since the Covid-19 pandemic took hold – businesses are looking for web-based solutions to grow their sales.

One such solution is trading automation. Trading automation makes it easier for merchants to list stock for sale, exposing their diverse inventory to an ever-growing marketplace. Regions that once struggled to find a secondary market have been benefitting from the shift to online sales, particularly as lockdowns have closed much of the physical retail. Through APIs, stockholders have been able to list and advertise various wines to a far greater audience, as merchants have connected their customers to this ever-broadening market. Subsequently, wine merchants and private collectors have been able to find less well-known wines from a greater range of wine regions.

Despite an early swoon as the first lockdown took place, the fine wine market would seem to be in a relatively healthy place today. As a tangible, finite asset, it offers stability in a volatile world. It also of course offers a great deal of pleasure for imbibers who are locked down and deprived of their usual wining and dining! And importantly technology, as in so many sectors, has helped merchants from across the globe, to adapt, making wine more accessible and more exciting to all with an interest in it. Combined, these three things have put the wine market on a firm footing in 2020.

Source: Liv-ex