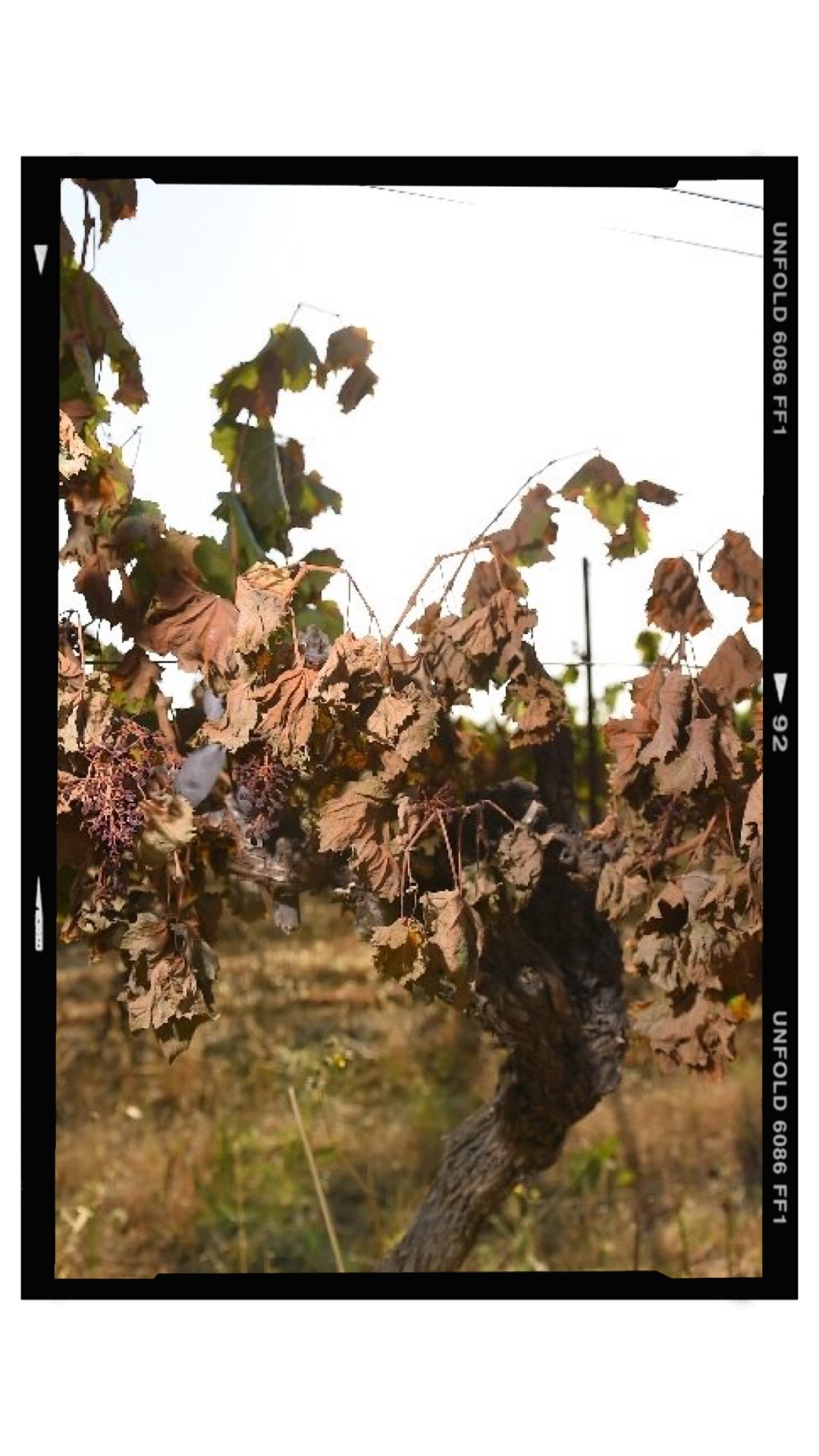

The Bordeaux appellations of Pessac-Léognan, Pomerol and Saint-Emilion have recently been granted permission to irrigate their vines this year after heatwaves and low rainfall across the region threaten the vines with hydric stress. The weather in these areas has been extremely dry for months and French national weather service, Météo France, has reported that July 2022 was the driest since 1959.

As regulated, irrigation is forbidden in the region although recent modifications to the winegrowers’ code “The Cahier des Charges” has allowed it under certain conditions. The Cahier des Charges of all three regions permits irrigation “only in case of persistent drought and when this disrupts the good physiological development of the vine and ripening of the grapes”.

Representatives of France’s national appellations body, the INAO, visited the Bordeaux region to review the situation.

According to news agency AFP, “three [appellations] obtained the authorisation to irrigate to try to preserve the threatened vines”. Other sources, such as local news publication Le Résistant, added that the authorisation also spans to the so-called “satellite” appellations of Saint-Emilion (Lussac-Saint-Emilion, Montagne-Saint-Emilion, Puisseguin-Saint-Emilion and Saint-Georges-Saint-Emilion) and Lalande-de-Pomerol.

The region is not equipped for irrigation with many relying on rudimentary technology to supply the water to the vines. According to AFP, the Bordeaux wine trade body is pinning its hopes on “two or three storms in the coming weeks” to make for “a good vintage”

#bordeaux #bordeauxwineregion #bordeauxwine #madeinfrance #bordeauxlovers #winelovers

#winenews #heatwaves #wine #bordeaux #winelive

![The 2021 Fine Wine Market Report [Liv-ex]](https://www.liz-palmer.com/wp-content/uploads/2021/12/Image-1.jpg)