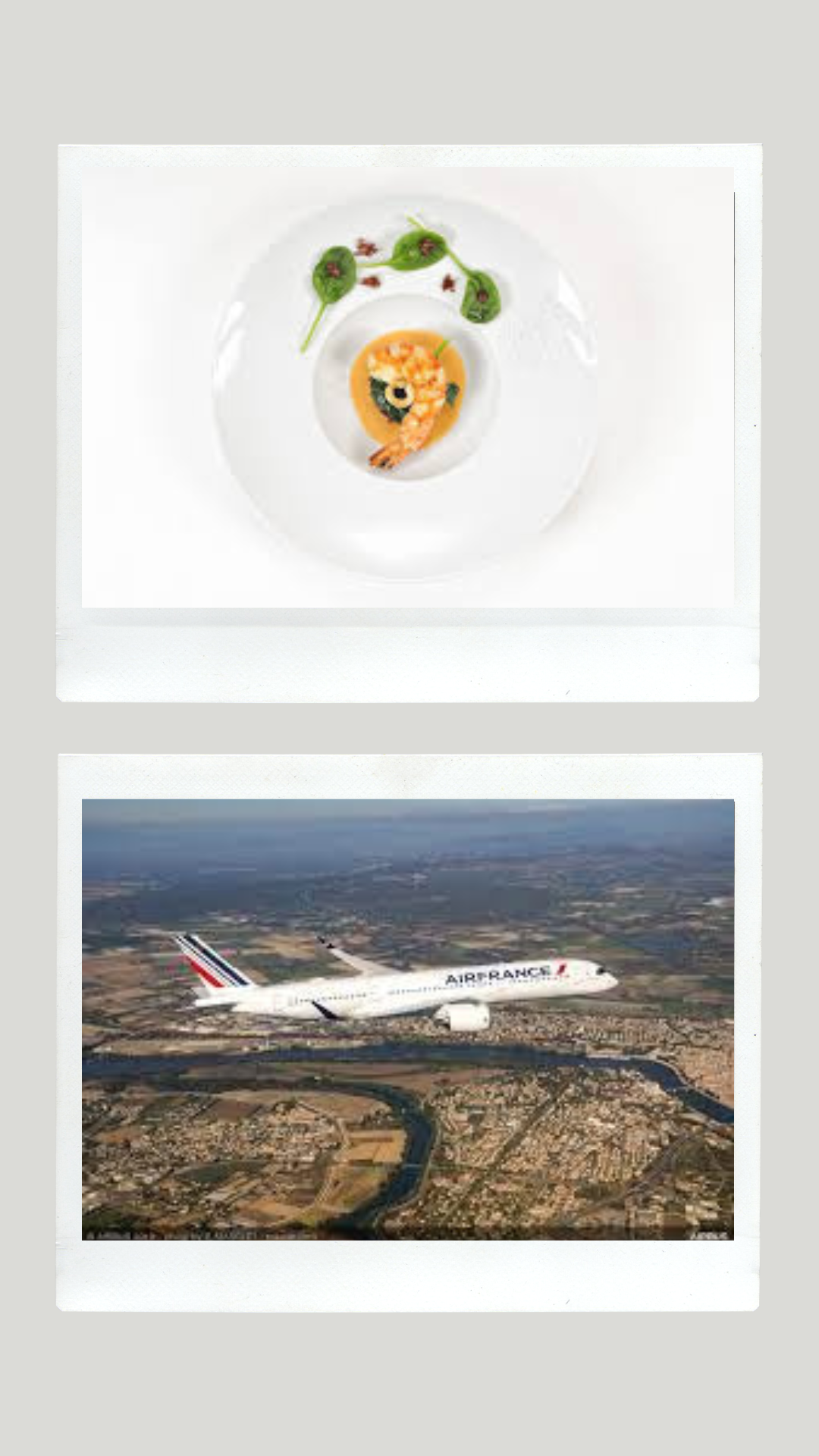

To mark Bocuse d’Or 2023, of which Air France is a partner from January 19 – 23, 2023, Air France has unveiled the names the famous chefs they will be working. 17 talented chefs promoting French excellence will take turns to sign exceptional dishes in La Première and Business, and in airport lounges over the next few months. Air France is the only airline to partner with so many distinguished names in the world of cuisine.

Air France is committed to introducing its customers to the quality and diversity of France’s gastronomic heritage, as part of an increasingly responsible approach, by focusing on fresh, seasonal and local produce and a systematic choice of vegetarian dish in all travel cabins.

A high-flying French dining experience

On board long-haul flights from Paris, French Michelin-starred chefs Arnaud Lallement, Régis Marcon, Anne-Sophie Pic, Emmanuel Renaut and Michel Roth will this year take turns to sign exclusive dishes for Air France on the La Première and Business cabin menus. Mauro Colagreco and Thierry Marx will also be contributing their unique skills to this exceptional team of chefs. With vegetarian compositions, red and white meats from France, and fish from sustainable fishing, all the chefs are committed to showcasing the local produce of their regions in France and sharing their culinary heritage and passion.

In the La Première suites, the company’s most exclusive travel cabins, the Meilleur Ouvrier de France pastry chefs Philippe Urraca and for the first time Angelo Musa will bring an elegant and sweet touch to the menus in this cabin worthy of the finest restaurants.

Air France also offer menus signed by top French chefs on long-haul flights departing from airports worldwide and continues to work with the triple Michelin-starred chef Julien Royer in the La Première and Business cabins on departure from Singapore. Originally from Auvergne, Julien Royer is at the helm of the Odette and Claudine restaurants in Singapore. On departure from Reunion Island, in the Business cabin, the menus are signed by chef Jofrane Dailly from Reunion Island, who works at the Diana Dea Lodge in Sainte-Anne. In 2023, Air France will offer menus signed by chef Olivier Perret on flights departing from Air France’s destinations in Canada (Montreal, Toronto, Quebec and Vancouver). He will focus on offering French gastronomy with fresh ingredients for menus in the Business cabin. Originally from Burgundy, the chef also presides at the restaurant Le Renoir at the Sofitel Montréal Le Carré Doré.

#airfrance #frenchdining #frenchwineandfood #madeinfrance #Avgeek #Aviation #Plane #businessclass #lapremière #finedining #champagne #topchefs #michelinstarred #michelinstarredchef #winelover #wine #travelling #deliciousjourneys