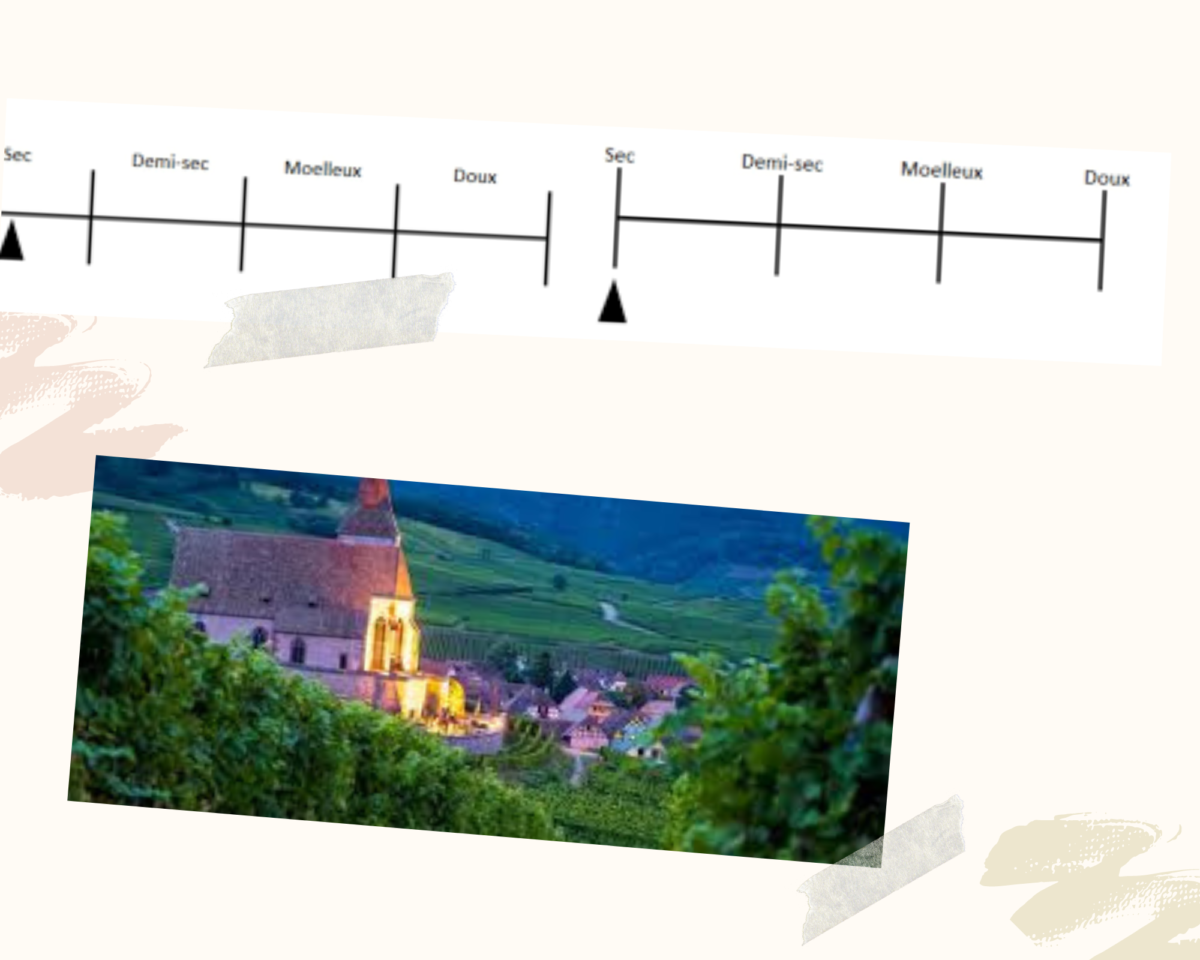

A standardized sweetness guide will be required on all Alsace wine labels starting with wines produced from the 2021 harvest.

While most French wines are labeled by origin, wines from Alsace are indicated by grape variety and location information, including if the wine is from one of the 51 grand crus. Now wine buyers and trade can also consult the bottle for a visual sweetness scale or one of the following appropriate terms.

The New Alsace Wine Sweetness Scale

The new sweetness scale is straightforward. The scale is in both English and French. Dry (sec) sugar content of the wine does not exceed 4 g/l

- Medium-Dry/demi-sec: sugar content of the wine is between 4 g/l and 12 g/l

- Mellow/moelleux: sugar content of the wine is between 12 g/l and 45 g/l

- Sweet/doux: sugar content of the wine exceeds 45 g/l

This change was prompted by the Alsace wine industry and centers on sweetness guidelines already in place in the European Union.

“In Alsace, we produce many different styles of wine, from dry wines to sweet wines to sparkling wines,” says Foulques Aulagnon, export marketing manager, for CIVA (Conseil Interprofessionnel des Vins d’Alsace) which is also known as the Alsace Wine Board. “This new standardized sweetness guide doesn’t affect how we produce our wines, but gives greater clarity on the style of what’s in the bottle.” Crémant d’Alsace, traditional method sparkling wine from the appellation, already has sweetness guide regulations and isn’t impacted by this new round of rules.

In addition to labels, the new system applies to advertising, marketing materials, invoices, and other containers. This is designed to be helpful to trade partners such as educators, retailers, and sommeliers.

According to CIVA data, export sales of Alsace wines grew by 22.4% in 2021. With more buyers outside of France, this move provides further understanding to new customers that may not be as familiar with what Alsace has to offer.

* According to EU regulations, “Dry” represents sugar content does not exceed 4 g/l (or 9 g/l if the total acidity in grams of tartaric acid per liter is not more than 2 g/l lower than the residual sugar content). “Medium-Dry” represents sugar content of the wine is above 4 g/l but does not exceed 12 g/l (or 18 g/l if the total acidity in grams of tartaric acid per liter is not more than 10 g/l lower than the residual sugar content).

#alsacegrandcru #alsace #riesling #whitewine #wine #wineharvest #winelover #alsacewine #grandcru #vinalsace #alsacegram #pinotgris #gewurztraminer #vin #vinblanc #wein #winenews