A new tool rooted in publicly traded wine companies and offering insights into the health of the wine sector has launched on winebusiness.com.

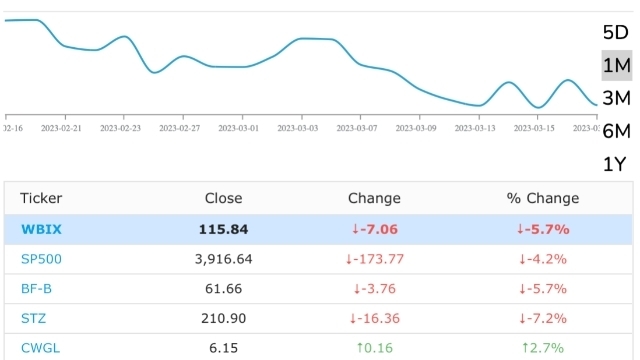

The WB Stock Index (WBIX) is a composite metric representing a portfolio of 13 publicly traded wine companies, weighted by each company’s annual wine revenue. The index reflects the daily percentage change in stock price at the end of the previous business day according to the significance of each producer in the marketplace.

The baseline for the index is Jan. 1, 2020, a time of strong performance by other indices and well before the onset of pandemic disruptions. The index stood at 119.02 as of March 1, indicating that publicly traded vintners have seen fortunes strengthen during the pandemic. The market’s confidence in the sector as a whole remains high. The index is intended to provide a snapshot in time and help benchmark a company’s performance against its peers. Performance can vary depending on the interval chosen, meaning a comparison across several intervals can be helpful.

Some of the strongest performers have been the luxury wine companies LVMH and Pernod Ricard, which have both performed well as aspirational and discretionary spending remained strong over the past year. LVMH’s share price has increased 28% over the past year to $170.45 while Pernod Ricard’s increased 3% to $42.22. The gains continued in the latest three months, with LVMH up 14% and Pernod Ricard up 7%, underscoring the long-term momentum underpinning each company.

The least fortunate company among those tracked by the index has been Vintage Wine Estates, which has seen its share price fall 83% versus a year ago to $1.39, with much of the slide registered in the past three months after the company restated earnings for the first quarter of fiscal 2023, released preliminary numbers for the second quarter that projected lower than expected revenue and gross margins for the year, and withdrew guidance on expectations for the remainder of the fiscal year, which ends June 30. The company also made a change at CEO with founding partner Pat Roney moving to the role of executive chairman and Director Jon Moramarco assuming the role of interim CEO. Moramarco is also the editor of the Gomberg Fredrikson Report and founder of bw166. On March 10, the company announced it had sold a 42-acre vineyard in Napa Valley for $11 million to reduce its overall debt. Following the sale, Vintage reported it owns approximately 1,600 acres of vineyards and leases an additional 800 acres.

Vintage is significant enough to influence the index but not sway it. Two of the largest components are instead LVMH and domestic vintner Constellation Brands, which has increased 2% over the past year but fallen 11% in the latest three months as its most recent earnings report underwhelmed the investment community. This is in line with the challenges other public companies have seen.

While a value decline can indicate a lack of confidence by the markets, it also creates a buying opportunity for long-term investors. The Duckhorn Portfolio, for example, has underperformed the index with a 19% drop in its share price over the past year. Currently trading in the range of $14.99, its shares have ranged between $12.64 and $22.29 over the past 52 weeks. Despite a lower price, several analysts have maintained a buy rating on the stock, an expectation that its share price will increase and reward investors. Bank of America analysts are among them, while Barclays upgraded its rating on the stock because of its latest earnings report.

This is in contrast with response to shifts in Vintage’s stock price, where sentiment has shifted in favor of “sell” from a uniform “buy” rating a year ago. Canaccord Genuity Group is among the bears, noting that it had more questions than answers about the company’s financials and future.

When it comes to public perception, however, the market is largely in favor of the wine sector. WBIX has outperformed the S&P 500, rising nearly 4% over the past year as the S&P 500 fell nearly 7%. The latest three months have seen it increase 2%, or twice the growth posted by the S&P 500.

Link to Index: https://www.winebusiness.com/finance/wbix

Source: Wine Business

![Winechain [a NFT platform] raises €6 million for expansion](https://www.liz-palmer.com/wp-content/uploads/2022/09/Gray-2-Travel-Photos-Polaroid-Instagram-Story.png)