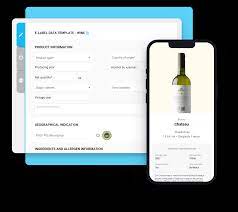

The CEEV – Européen des Entreprises Vins, and spiritsEUROPE have teamed up with QR code compliance solutions firm Scantrust, to unveil an updated version of the U-label labelling platform.

According to the groups, the strategic partnership will facilitate the easy creation of e-labels for both the wine, aromatised wine and spirits drinks.

The U-label by Scantrust aims to simplify compliance with the new EU labeling regulations for wineries in a cost-effective manner. Additionally, it assists spirits producers in advancing the implementation of the Memorandum of Understanding on consumer information, which was adopted in June 2019.

Empower Wine Producers

“When we conceived U-label, our goal was to empower European wine producers large and small with an affordable turnkey solution for navigating the new labeling regulations,” commented Ignacio Sánchez Recarte, CEEV Secretary General.

“This partnership with Scantrust represents a significant milestone in achieving that goal.”

In a statement, CEEV and spiritsEUROPE expressed their commitment to continue supporting and contributing their expertise in the wine and spirits industries to the U-label initiative.

The new U-label by Scantrust platform meets EU Regulation 2021/2117 requirements, including recent clarifications by the European Commission.

Comprehensive Information

“As European spirits producers, we are progressing fast in providing comprehensive, easily accessible consumer information via e-labels in combination with energy-information on-pack,” said Ulrich Adam, Director General of spiritsEUROPE.

U-label will allow spirits producers large and small to roll out state-of-the-art digital labelling solutions together with an experienced and reliable partner.