The year 2023 will undoubtedly be remembered by the world’s wine fraternity as one of the most challenging.

This rings true in the context of South African wine exports as well, with volume declines of 17%, resulting in total export volumes of 306 million litres. The silver lining for South African producers can be seen in positive value growth of total exports to a respectable US$540 million (R10 billion), despite the volume decline.

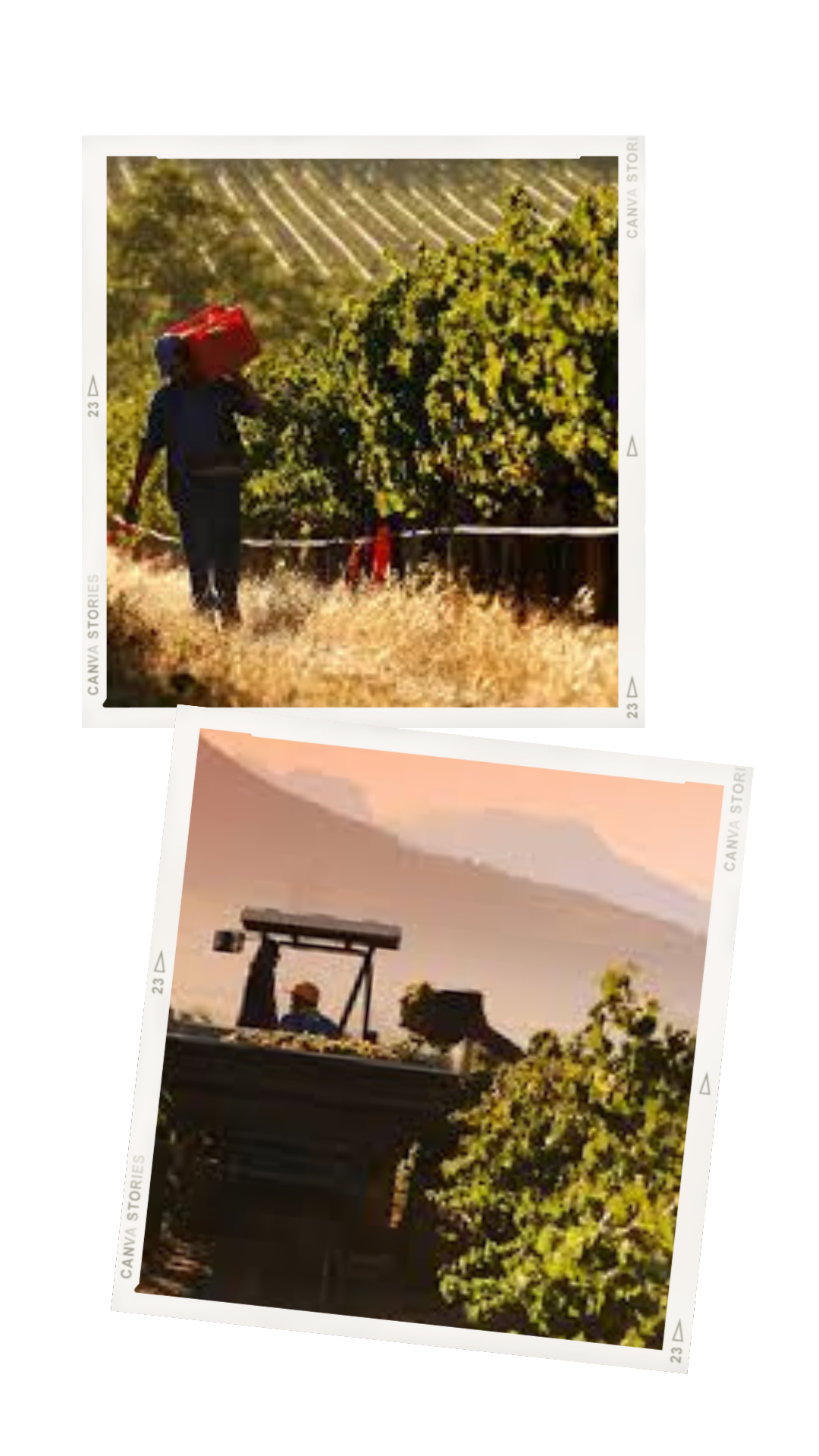

Harvest 2023 saw production volumes decline by 14%, a scenario echoed by the OIV report which highlights smaller harvests globally for the year, however, the realities of excessive stocks in both northern and southern hemisphere producing countries, has had an adverse effect on pricing on the whole. This can especially be seen at the lower- and entry level segment of the wine markets where trading is particularly competitive and pricing within this commodity sector leading to a ripple effect throughout the value chain.

Despite these challenges, South African wines are still making waves internationally with continuous positive recognition from critics such as Tim Atkin, MW in his latest South African report and Anthony Mueller’s latest report on the Wine Advocate platform. It is this reputation for top quality wines that seem to be setting South African wines apart from many of our counterparts and fueling the positive premium growth trajectory.

“The consistent positive ratings and accolades achieved by South African wines has most certainly solidified our positioning in international markets. Quality remains our focus and the consistency that we have seen, along with viticultural improvements, embracing new technologies both in the vineyards and cellars, will allow for the continued upward trajectory in this regard. This is why buyers remain confident in their support of our wines,” comments Wines of South Africa CEO, Siobhan Thompson.

She adds, “Thanks to our unique terroir, our producers are known for making wines that are unique and representative of our rainbow nation.”

In addition to this, wine tourism in South Africa is projected to have further bolstered growth, adding to the overall sustainability of particularly the small and medium sized entities.

In an upcoming report following a wine tourism impact study (due for release on 1 February 2024), preliminary figures have shown exponential growth in numbers and turnover at cellar doors, with full recovery following the Covid pandemic. This growth can be accounted for by both local and international visitors to the Cape winelands.

South African white wine continues to win the popularity contest with Sauvignon Blanc leading the charge, followed by Chenin Blanc and Chardonnay. All three cultivars also showing solid value growth. On the red wine side of things, Shiraz takes the lead, closely followed by Pinotage and Cabernet Sauvignon.

Producers continue to face several localised challenges. One of the main issues is the ongoing infrastructure and equipment challenges at the Port of Cape Town, which has had a major impact on all products and commodities that are heavily reliant on this harbour.

Newly formed wine industry body, South Africa Wine, together with exporters, are continuously engaging with port authorities and have taken a proactive approach in finding ways to support producers in this regard. However, a long-term strategy needs to be implemented to truly negate and ultimately correct these challenges.

“Order fulfilment is key in the international wine business and we cannot allow delays due to a below-standard logistical performance to tarnish our reputation as a reliable supplier of quality wine,” says Christo Conradie, stakeholder engagement, market access and policy manager at South Africa Wine.

“Transnet (Port of Cape Town) is a crucial enabler to ensure we deliver on our global promise and we have the undertaking that Transnet will step up to the mark, focusing on the controllables via a collaborative effort. Notwithstanding some real logistical challenges, we are confident for the future and are committed to honouring all agreements.”

There is no doubt that 2024 will continue to see challenges for the South African, and indeed, the global wine industries as geopolitical pressures will continue to play a major role in the world economy. Despite this, South Africa and the South African wine industry remains open for business and the export of South African wine remains a major focus.

For more information, visit www.wosa.co.za