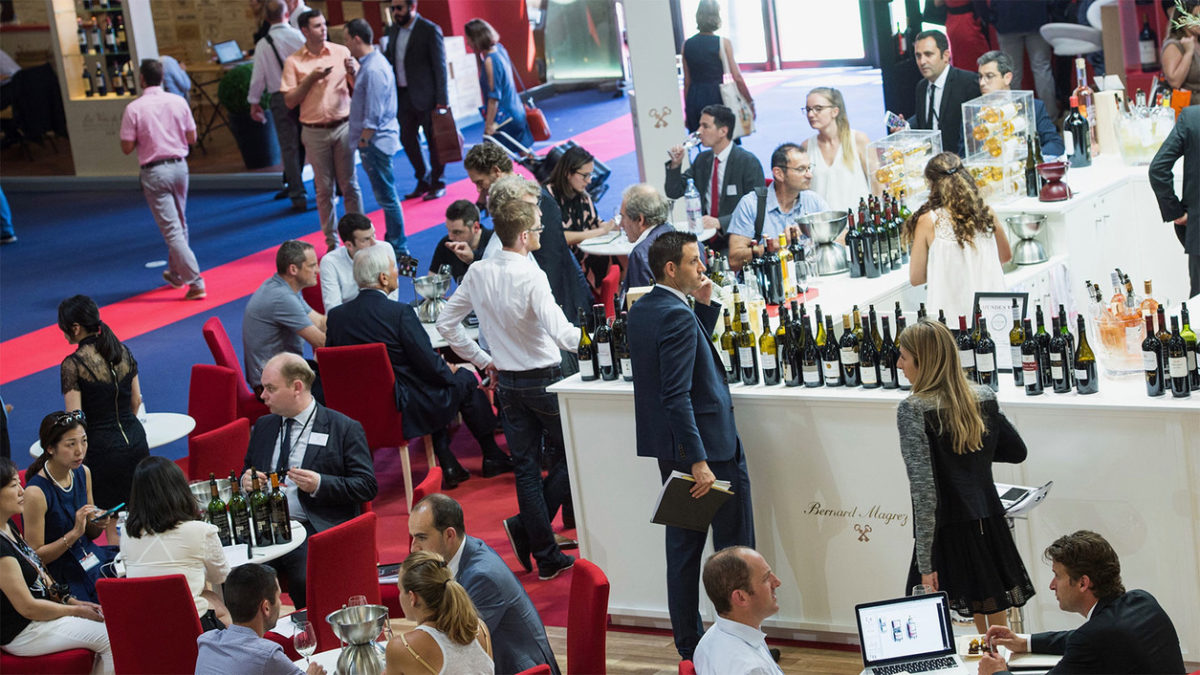

At its AGM last month, the Provence wine council (CIVP) approved a three-year action plan costing €7 million a year, which includes drives in no fewer than 15 export markets. From 2019-2024, Provence’s producers have established a clear agenda to support premiumization of their wines; increase the share of exports from 37% to 45%; and diversify shipment destinations, particularly towards the Asia/Pacific region (more specifically to China and Japan).

“Our actions in France and abroad are aimed at constantly increasing the reputation and image of our appellations across the globe. A levy increase is never taken lightly. This bold decision is a sign that producer companies are aware of the challenges to be met and the collective resources that need to be deployed”, states Jean-Jacques Bréban, chairman of the Provence wine council.