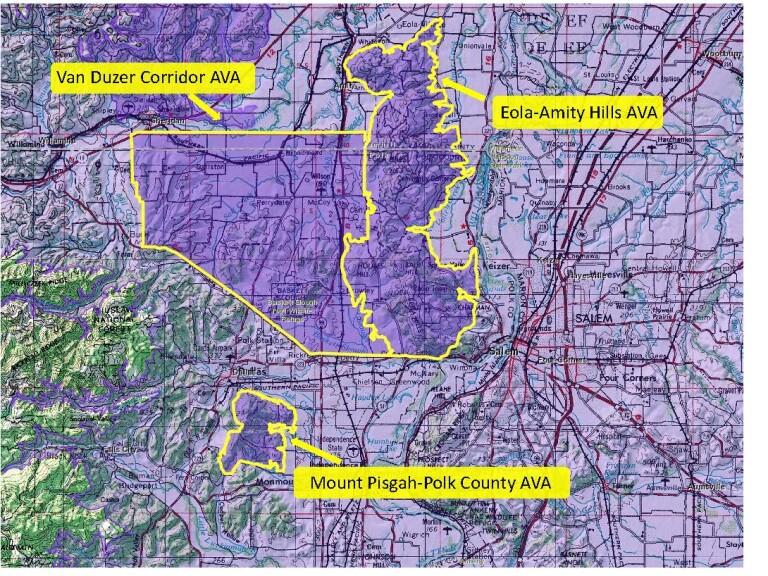

Mount Pisgah, Polk County, Oregon, the newest appellation in Oregon and nested American Viticultural Area (AVA) in the Willamette Valley, has received federal recognition as an official AVA. Drawn to reflect distinct soil, topography and climate attributes.

This new AVA becomes the 23rd federally recognized winegrowing region in Oregon and the 11th nested AVA within the Willamette Valley. The new nested AVA was granted approval by the Alcohol and Tobacco Tax and Trade Bureau (TTB) on June 3, 2022 ,and takes effect on July 5, 2022.

Located in Polk County, the Mount Pisgah, Polk County, Oregon AVA is characterized by the warmth of the nearby Willamette River, the mild influence of the Van Duzer winds, and the rain shadow of Laurel Mountain to the west. It is the Valley’s second smallest AVA at 584 planted acres but one of its most densely planted. Mount Pisgah was formed 65 million years ago as a sea floor volcano and has since been covered by marine sediment which pushed up out of the ocean. This unique geology allows the grapes to develop a deep complexity in the region’s shallow soils.

Brad Ford, of Illahe Vineyards petitioned the TTB five years ago for the addition of the AVA to the wine country map. Ten vineyards and three wineries join the new Mount Pisgah, Polk County, Oregon AVA.

“Thanks to an excellent group of growers who helped identify the most important aspects of our little mountain, I have no doubt we will continue to work together to build a beautiful destination for people willing to go the extra mile,” said Ford.

“Recognition of Mount Pisgah, Polk County, shows again how we continue to learn about, and appreciate, new areas of viticultural distinction in Oregon. Each one adds its own chapter to Oregon’s story of unique soils, unmatched geology, topography and globally recognized wine quality” said Oregon Wine Board President Tom Danowski. “These federal AVA designations take years to achieve as the standards are rigorous for establishing a region as clearly differentiated.”

“We’re so excited to see Mount Pisgah, Polk County, Oregon AVA recognized in the larger story of the Willamette Valley,” said Morgen McLaughlin, executive director of the Willamette Valley.

Details of Mount Pisgah, Polk County, Oregon AVA

Official date of recognition: June 3, 2022

Final rule is effective: July 5, 2022

Total acreage: 5,530

Planted acreage: 584

Number of wineries: 3

Number of vineyards: 10

Varieties: Pinot noir, Chardonnay, Pinot gris,

Tempranillo and Pinot blanc

Soil: Marine Sedimentary

Wineries

Illahe Vineyards

Open Claim Vineyards

Amelie Robert Estate

Vineyards Include

Illahe Vineyards

Ash Creek Vineyards

Open Claim Vineyards

Erratic Oaks Vineyard

Freedom Hill Vineyard

Croft Vineyards

Fern Creek

Amelie Robert Estate

Mistletoe Vineyards

Cooper Hollow

#ORwine #OregonWine #wine #winetime #winelover #winery #Oregon #WinesofOregon #winesofinstagram #winetasting #oregonwinecountry #TravelOregon #USwine @oregonwineboard