Champagne sales are bubbling again.

The French industry is preparing for a bumper holiday season, a significant recovery from just two years ago, when it slashed production in the face of the global economic downturn.

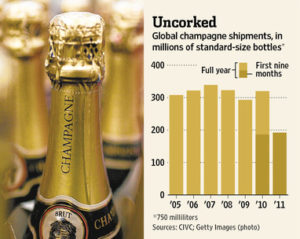

By the end of September, the Champagne industry had shipped 192 million bottles, and the festive fourth quarter is usually the strongest, accounting for a third to a half of annual bubbly sales. That could put it on track to near the record 339 million bottles shipped in 2007.

The Champagne rebound reflects the effervescence in the luxury-goods industry as a whole. The world’s largest luxury-goods group, LVMH Moët Hennessy Louis Vuitton, the owner of fashion and beauty brands such as Louis Vuitton and Guerlain as well as several champagne labels, recorded 15% sales growth over the first nine months of 2011. Luxury fashion rivals such as Hermès and PPR’s Gucci logged similarly robust growth.

“Champagne sales are faring well ahead of the holiday season and are up 15% compared to 2010,” said Emeric Sauty de Chalon, president of French online wine shop 1855, which last month organized a major Champagne tasting in Paris.

Though sales may not reach the levels seen before the crisis, “we’re getting closer,” said Stephanie Mingam, the spokeswoman for drinks group Pernod Ricard’s Champagne division, which owns Mumm and Perrier-Jouët champagne.

The industry took a serious hit in 2008 and 2009. Champagne makers—famous-brand and independent producers alike—cut production drastically to avoid a large drop in prices, leaving tons of grapes rotting in the fields during the harvest.

Shipments from the Champagne region—located east of Paris, and the only place in the world that is permitted to use the region’s name for its bubbly—fell below 300 million bottles in 2009 for the first time in five years, according to CIVC, the champagne trade organization. Last year, the industry shipped 320 million bottles, valued at €4.1 billion ($5.49 billion), the CIVC said.

Like the luxury-goods industry in general, however, champagne makers remain cautious about the future. They fear that a deepening of the euro crisis could dampen consumers’ thirst for a beverage that is associated with celebration and good times. Mr. Sauty de Chalon is now pitching bubbly as a distraction rather than a celebration. Champagne “is a means to escape everyday life,” he says.

The first signs of a bumper year came this past summer. The CIVC, which sets the criteria for the harvest, authorized the maximum volume of grape picking—a sign of optimism for the medium term as grapes picked this year will be aged for at least two years.

Then, in October, LVMH said the group’s Veuve Clicquot Champagne was holding back some stock as it faced supply shortages ahead of the holiday season, particularly in the U.S. “We don’t have enough bottles, and we made sure that these bottles were left for the year-end season,” Jean-Jacques Guiony, the finance director, said in October. LVMH also owns such Champagne brands as Dom Pérignon and Moët & Chandon.

Other Champagne makers have also noted that consumers are willing to pay more for their bubbly. Lanson-BCC, the home of the Lanson, Besserat and Tsarine brands, said the price/mix effect—a key indicator reflecting both the type of Champagne customers buy and the evolution in prices—rose 5.6% in the first nine months of the year. Competitor Laurent-Perrier said its price-mix effect increased 7.6% between April and September, and its net profit tripled.

That marks a sharp contrast with discounted Champagne in French supermarkets last December, when some bubbly was marked down to less than €10 a bottle.

This year, 1,500 visitors paid €25 each to attend 1855’s champagne tasting at a luxury hotel in Paris. They swarmed tables serving such brands as Mumm Grand Cru, Perrier-Jouët 2004 Belle Epoque and Louis Roederer 2004 Cristal. Within four hours, the party had run dry.

The Wall Street Journal